According to data compiled by Insurance.com for the year 2022, the typical annual premium for a policy providing $300,000 in dwelling coverage and liability with a $1,000 deductible is $2,777.The average cost for a policy with $200,000 in dwelling coverage is $2,233, while the cost for a policy with $500,000 in dwelling coverage is $3,594. The cost of insurance depends on several factors, including the home’s age and square footage, the homeowner’s claim history, the cost of building materials, and the homeowner’s geographic location.

You must get homeowner’s insurance if you own a home. Your mortgage lender may insist on it, but you should get it because you’re the one who really needs it and will profit from it. Your house and possessions are your most valuable assets, and homeowners insurance will safeguard them.

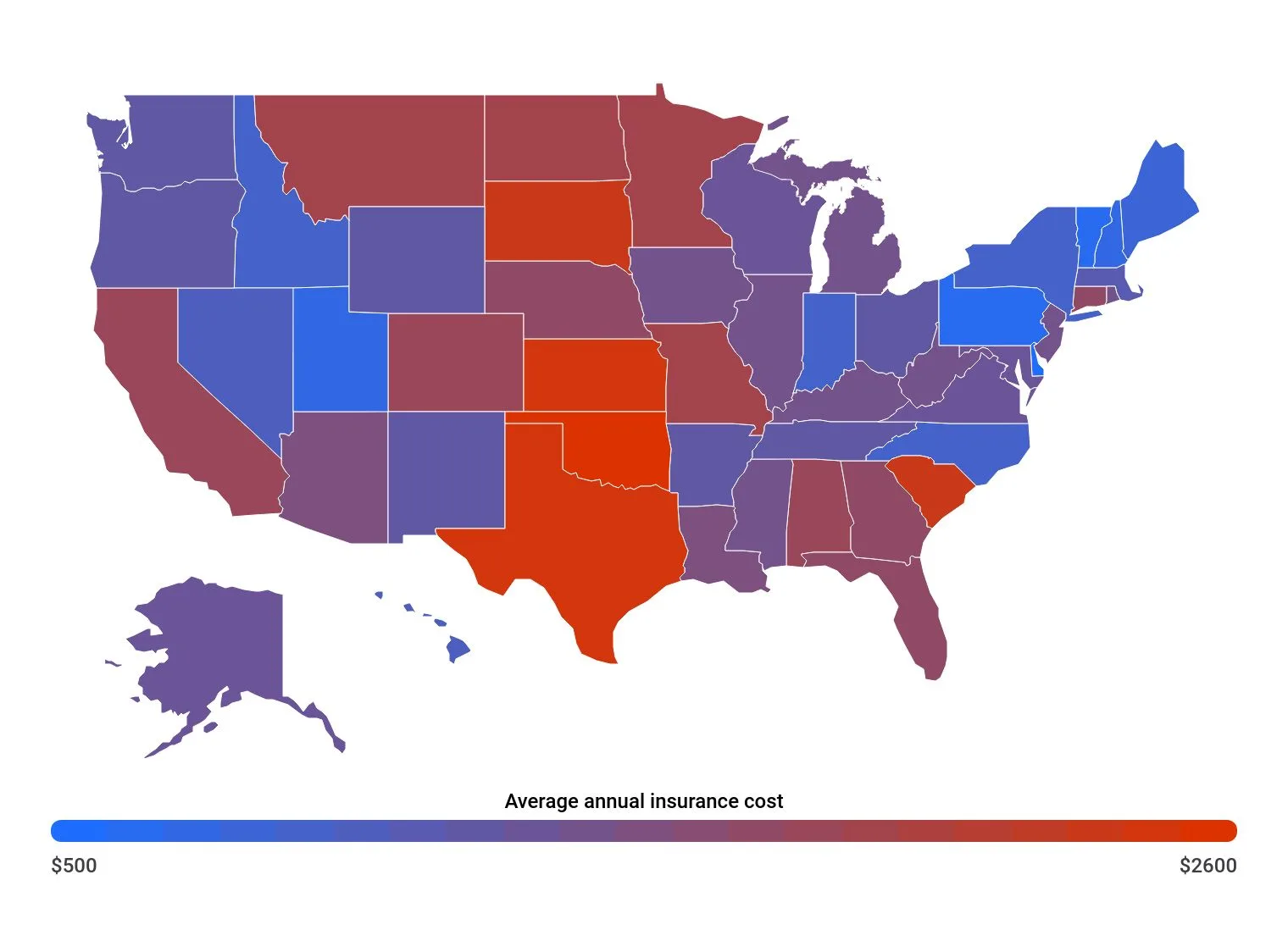

The Typical Cost of Homeowners Insurance Across the Country

Hawaii’s average homeowner’s insurance premium is the lowest in the US at $558, according to our research. Oklahoma has the lowest average yearly rate, at $4,122. The $3,564 monthly cost disparity demonstrates how significantly location impacts the value of a property. The remaining four states in the top five for least expensive homeowners insurance are:

- Utah: $817

- Oregon: $834

- $944 Vermont.

- $961 in the Granite State

Other states like Oklahoma, which is in the middle of this country and subject to extreme weather, also rank high for the cost of homeowner’s insurance.

- $3,309 in Nebraska

- $3035 in Kansas

- Texas: $3,013

- $2,988 in Louisiana

Largest rises in home insurance premiums

Our Home Insurance Pricing Report shows that in many areas across the United States, homeowners’ insurance premiums are increasing at a rate higher than inflation. Costs for homeowner’s insurance in Arkansas, Washington, and Colorado all rose by more than 17% between May 2021 and May 2022. The rising cost of homeowner’s insurance has prompted many to question the reasoning behind this trend.

Several factors, including the rising value of your property and the probability that you would file a claim, have contributed to a rise in the cost of homeowners’ insurance. Keep in mind that the amount your insurance pays out is determined by how much it would cost to replace your property completely. Replacement prices and, by extension, your homeowner’s insurance premiums, go up when building projects experience setbacks like inflation and shipping delays. Natural catastrophes are becoming more common, and this has led to an increase in the demand for resources and labour, which in turn has driven up the cost of house insurance.

What Factors affect the cost of Homeowners Insurance?

There are six primary types of home insurance protection. An explanation of the many forms of protection is as follows.

Dwelling coverage – This coverage (coverage A) safeguards your home’s framework, including the basement, the first and second floors, the walls, and the roof.

Coverage or “other structures coverage,” safeguards buildings that aren’t attached to your primary residence but are still on your property, like storage sheds and fences. Typically, this percentage is set at 10% of the total insurance on your home.

Coverage of personal property safeguards your possessions everywhere they may be, not just at home. Coverage C will reimburse you for the cost of replacing or repairing your property if it is damaged by a covered risk. This amount of protection normally corresponds to half of your home insurance.

You can get your money back if you have to temporarily move out of your house thanks to coverage for loss of use and additional living expenses (coverage D). It can cover things like food, lodging, laundry, and more.

Coverage Liability provides provided when a visitor is hurt on your property & you are held responsible for their medical bills. The policy will pay to replace any personal property that is destroyed while it is in your house.

Coverage of your homeowner’s insurance policy is “medical payments to others,” and it kicks in if someone is hurt on your property & it wasn’t your fault.